TEAMWORK MAKES THE DREAM WORK WITH TAX PRO PARTNERS COLLECTIVE

Grow Your Tax Business with the Right Partners!

Why Join Our Tax Pro Partners Collective?

✔ Professional Tax Software

Professional Cloud based tax software with Mobile App, integrated bank products that make receiving payments for services easy and no upfront cost to your tax clients.

✔ Partnership Opportunities

Being a partner allows you partnership opportunities to grow your brand by participating with partnerships we have established with outside partners, shared group benefits as a whole to help expand your reach of being notice

✔ Keep 100% of your tax prep fees

All of your fees charged are yours to keep except bank product and software service fees.

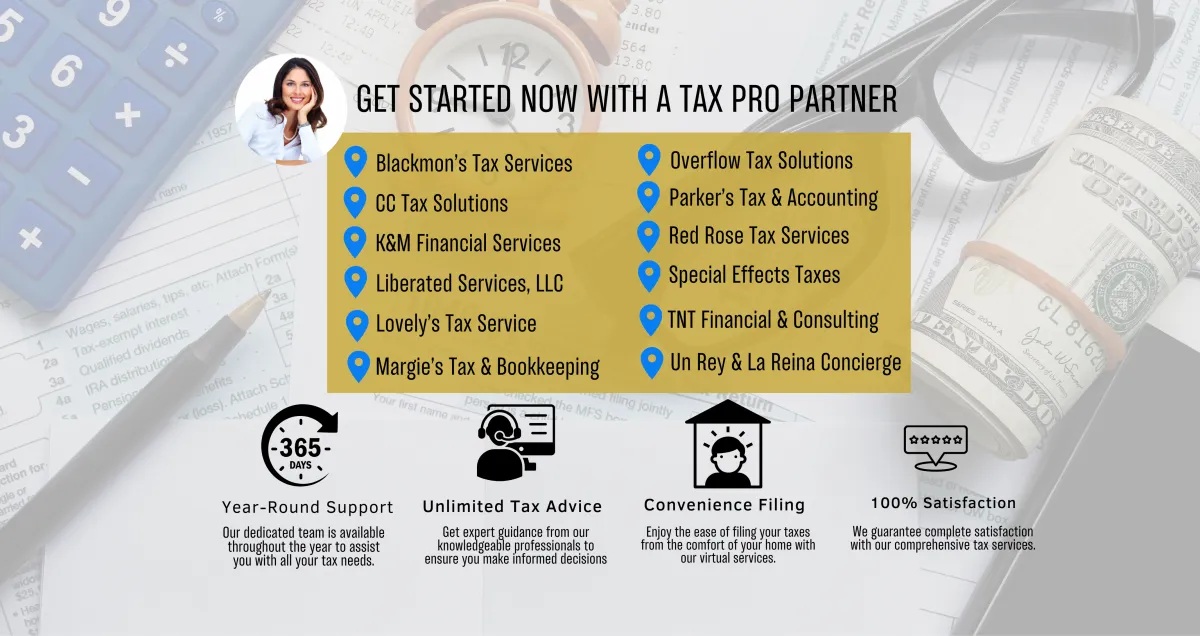

✔ Business Visibility – Get listed on our partner website with an email mailbox.

Your Company Listed on Collective Group Website with an Email Mailbox

✔ Opportunity to Brand Your Office Software & Mobile App

Branding is everything.

Your ability to have your logo branded in our tax software and on our mobile app is available.

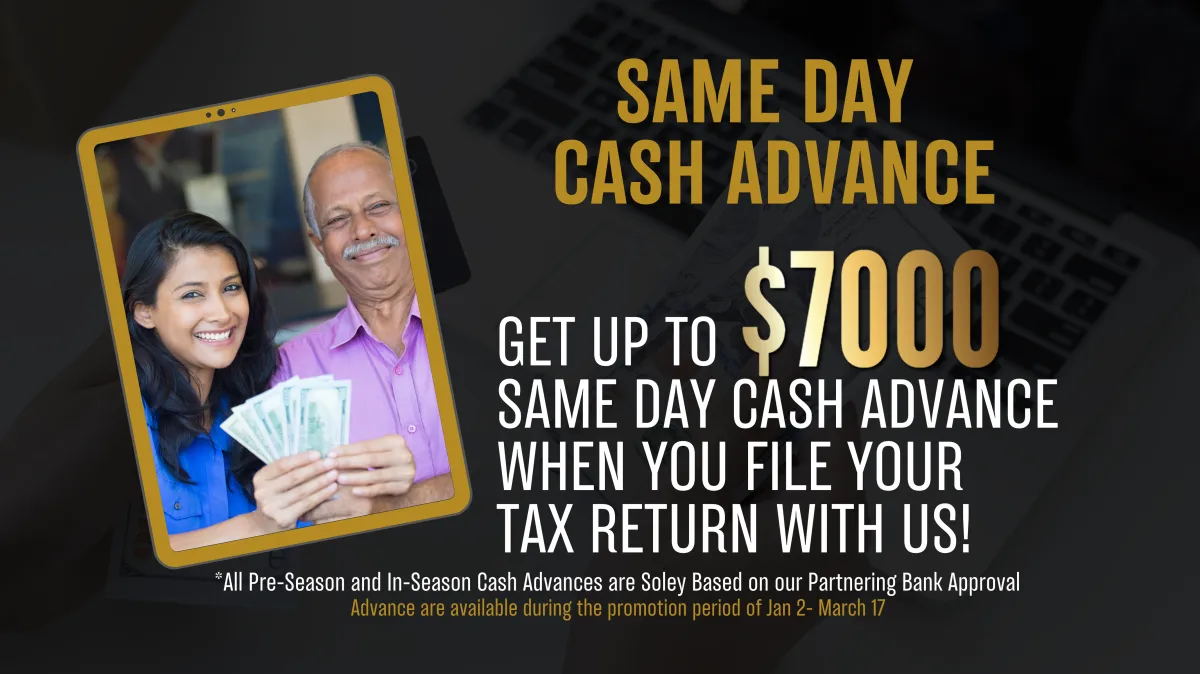

✔ Offer Refund CASH Advances

Cash advance opportunity are included as an option. Advances starts Jan 2 every tax season.

✔ Mentorship and Coaching

Receive monthly coaching calls and receive the ongoing strategy and support to grow your brand.

✔ Software Training

Receive weekly software training through zoom meetings. The zoom allows you to invite your team for training. Also included is practice tax returns of assorted tax scenarios.

✔ Private Facebook Tax Pro Partners Community

Collaboration and being in a community of well diverse knowledge puts you in a better position to learn or share something with other partners

✔ Virtual Assistance for Social Media and Digital Marketing

As partner we know running a tax business can be alot, we have incorporated 6 months with VA in our partnership to help you balance the workload,with an assigned VA you can now propel your tax practice to another level. Any areas you are needing support your assigned VA can assist with content, website, social media interactions, posting, flyer creations and email campaigns.

✔ Group Marketing Campaigns on Social Media Platforms

Two is always better than one, shared campaigns create major impacts when we can collectively be on one accord with one common goal. Marketing to FB, IG and Google Ads.The overall collaboration as a partner makes all our goals a success while reaching the massive.

✔ Bank Product Training

Bank products are Gold when offered with in the tax software. No upfront cost for your tax client to pay out of pocket. Your fees are collected through the bank products both collectible and non-collectible methods.

✔ Continuous Education Course Learning Platform

Get unlimited learning with one simple subscription and every credit counts! You’re getting exclusive one year access to fresh, cutting-edge Tax content that no one else has. We keep you at the forefront of your career with the most up-to-date.

• 4,000+ IRS Approved CE Hours – Go beyond compliance and level up your expertise.

• IRS Approved and Circular 230 Specific Ethics Course Available. (Include in Subscription)

• 90% On-Demand Learning – Take courses at your convenience, anytime.

• Upcoming Live Webinars, E-Books, Packages and Certificate Programs• Mobile Access – Earn credits from anywhere with our easy-to-use app.

• $4,000 in Advanced Certifications – Yours for free—boost your credentials!

• Credit Tracker & Compliance Reports – Stay on top of your requirements hassle-free.

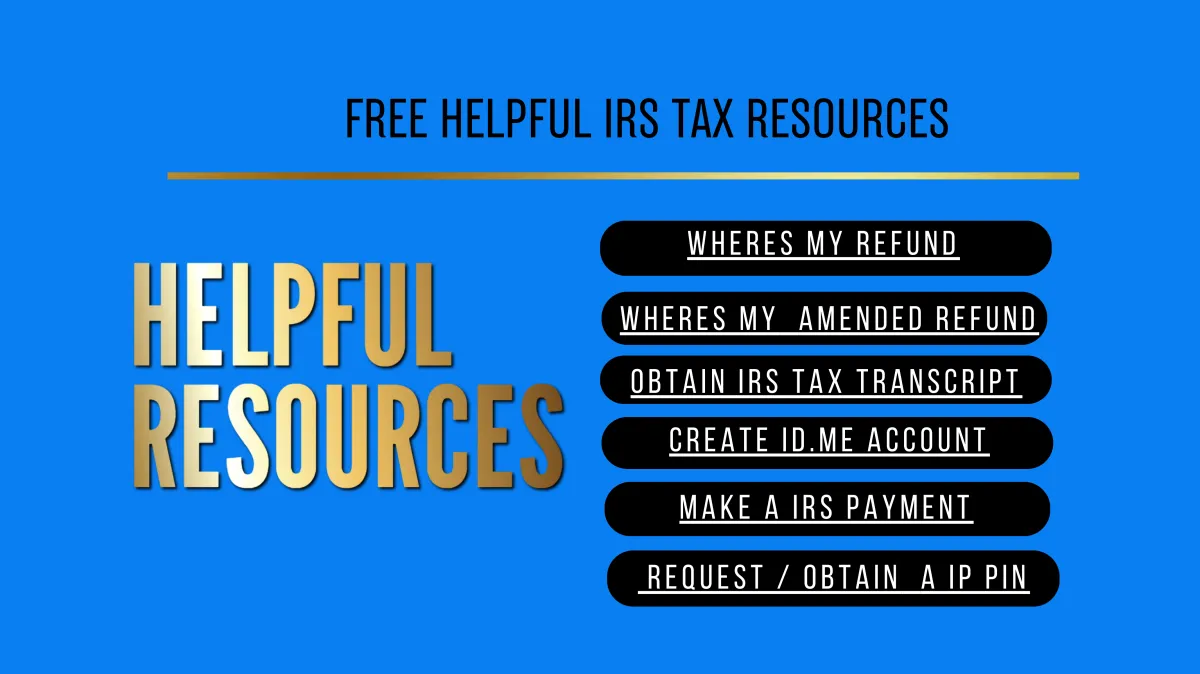

✔ Other Resource Opportunity

Gain access with outside resource tools used for referral marketing, CRM‘s, Tax Academy and Vacation Incentives

Unlock your Potential as a

Tax Professional

LV1 – PTIN to EFIN:

Step into the industry as your own boss with EFIN support.

LV2 – Solo ERO:

Run your tax business independently with full control.

LV3 – ERO with a Team:

Build and lead a team of tax preparers for greater success.

LV4 – Sub Service Bureau:

Scale your business, automate operations, and grow teams.

CE Courses in One Place

Online EA CE Courses

4,000+ Hrs of IRS-Approved Content100+ Emerging Subject AreasCircular 230 and Tax Ethics IncludedExclusive Monthly Tax UpdatesAccess to Tax Compliance Conferences

CTEC Approved Courses

4300+ Hrs of CTEC Approved Content100+ Emerging Subject Areas700+ Instructors from IndustryCRTP Ethics Course IncludedAccess to Virtual Conferences

AFSP CE Courses

4,000+ Hrs of IRS Approved ContentAFTR Course Included50+ Emerging Subject Areas700+ Instructors from IndustryCircular 230 and Tax Ethics Included

ORTP CE Courses (Oregan Registered Tax Preparers)

"Testimonial lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim dolor elit." - Your Name

MRTP CE Courses (Maryland Tax Preparer)

5,000+ Hrs of IRS Approved CE Content500+ Emerging Subject Areas700+ Instructors from Industry100+ Conferences with Access to Industry EventsEthics Course Included

We do the hard work WITH PARTNERSHIP

At Tax Pro Partner Collectives, we handle the heavy lifting so you can focus on what you do best. Our collective group offers comprehensive support and benefits to enhance your practice: with every bank, software provider, virtual assistant and outside partnership for our partners.

CONTACT US

Copyrights 2025 |Copy Club Tax Pro | All Rights Reserved.